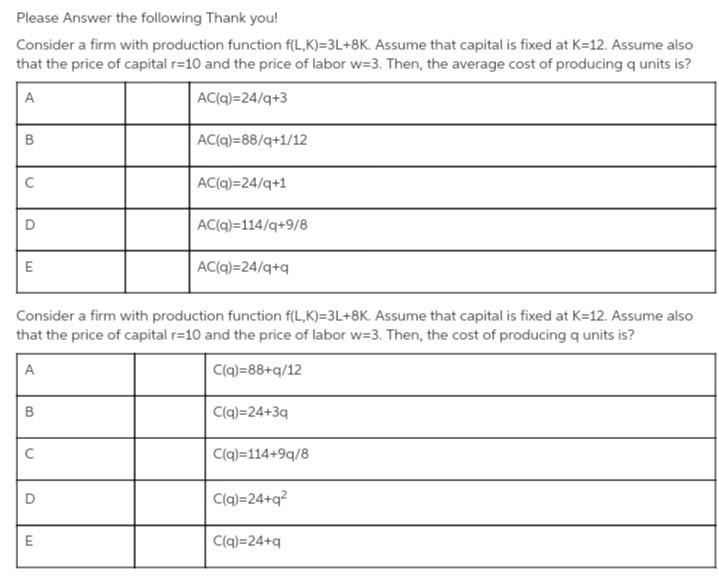

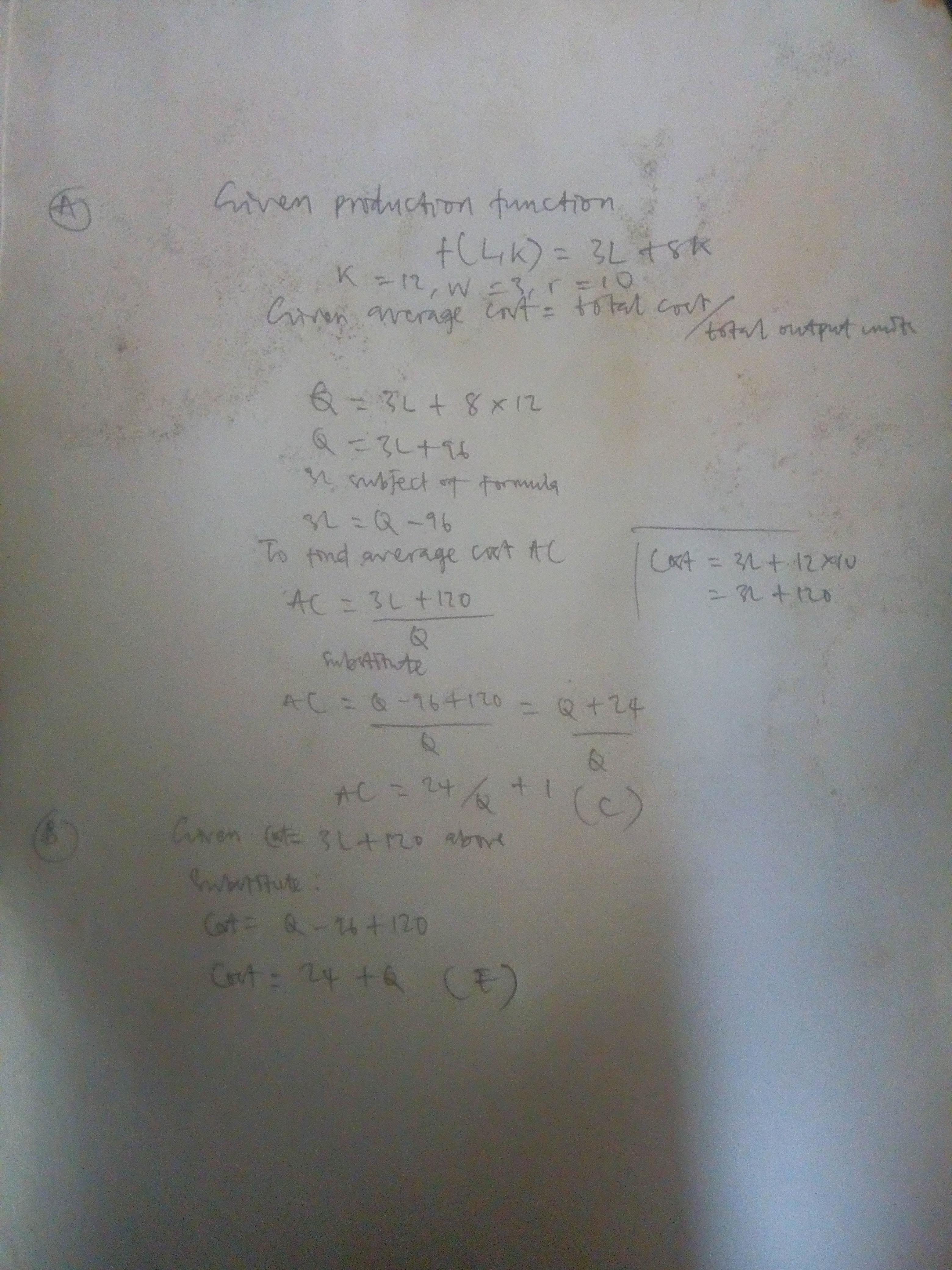

Consider a firm with production function F(K, L)=3L+8K. Assume that capital is fixed at K=12. Assume also that the rental rate (price) of capital r=10 and the wage rate (price) of labor w=3. The cost of production is the total expenditure on capital (fixed cost) and labor (variable cost). Then the cost of producing q units is__.

A. C(q)=114+(9q/8).

B. C(q)=24+39.

C. C(q)=88+(q/12).

D. C(q)=24+ q.

E. C(q)=24+q2

Answers

Question attached

Answer and Explanation:

Answer and explanation attached

Related Questions

The process of taking cash flow that is received or paid in the future and stating that cash flow in present value terms is called discounting. A. True B. False

Answers

Answer:

A. True

Explanation:

The process of taking cash flow that is received or paid in the future and stating that cash flow in present value terms is called discounting.

Discounting is the opposite of Compounding because discounting measures what the value of future cash flow is worth in the present while compounding takes the present value into the future. Discounting generally points to a method of knowing the present value of cash flow. Discounting is an important tool due to how a business could know the present value of what the business spends and gains by comparing it to the future value of what is to be received.

The cash flow that is received or paid in the future is less than the present value of the cash flow and that depicts the time value of money.

Linden, Inc. uses a 5,700 square foot factory space that it rents for $2,800 a month for all its manufacturing activities. Linden has decided to switch to an activity-based costing system, and has identified its activities as follows: Preparation and Setup, Machining, Finishing, and Quality Control. 2,600 square feet of the factory are used for machining, while 1,300 square feet (each) are used for Preparation and Setup and Quality Control. Finishing uses 500 square feet. When assigning indirect costs to each activity, how much factory rent should be assigned to the Preparation and Setup cost pool

Answers

Answer:

$639

Explanation:

Rent assigned to preparation and setup = Total rent / Total space * Space used by preparation and setup

= $2,800 / 5,700 * 1,300

= 638.5965

= $639

Therefore, the factory rent that would be assigned to Preparation and Setup cost pool is $639.

Park competes with World by providing a variety of rides. sells tickets at $110 per person as a one-day entrance fee. Variable costs are $44 per person, and fixed costs $412,500 are per month. Under these conditions, the breakeven point in tickets is 6,250 and the breakeven point in sales dollars is $687,500.

Requirement

1. Suppose Park cuts its ticket price from to to increase the number of tickets sold. Compute the new breakeven point in tickets and in sales dollars. 2. Begin by selecting the formula labels and then entering the amounts to compute the number of tickets must sell to break even under this scenario

Answers

Answer:

Instructions are below.

Explanation:

Giving the following information:

Variable costs are $44 per person

Fixed costs $412,500

Let's suppose that the new selling price is $100.

To calculate the break-even point in units and dollars, we need to use the following formulas:

Break-even point in units= fixed costs/ contribution margin per unit

Break-even point in units= 412,500 / (100 - 44)

Break-even point in units= 7,366 units

Break-even point (dollars)= fixed costs/ contribution margin ratio

Break-even point (dollars)= 412,500 / (56/100)

Break-even point (dollars)= $736,607

Holiday Laboratories purchased a high-speed industrial centrifuge at a cost of $470,000. Shipping costs totaled $14,100. Foundation work to house the centrifuge cost $7,700. An additional water line had to be run to the equipment at a cost of $2,600. Labor and testing costs totaled $7,000. Materials used up in testing cost $3,700. (Leave no cells blank. Enter 0 where needed.) a. What is the total cost of the equipment

Answers

Answer:Total Cost of equipment=$502,500

Explanation:

Total Cost of equipment= This is gotten by addition of Cost of Purchase +Shipping costs +Foundation work+ Testing expense

=$470,000+$14,100+$7,700+($7,000+$3,700.)

=$502,500

The following account balances were listed on the trial balance of Edgar Company at the end of the period: AccountBalance Accounts Payable$31,600 Cash 49,900 Common Stock 35,000 Equipment 16,000 Land 47,500 Notes Payable 62,500 The company’s trial balance is not in balance and the company’s accountant has determined that the error is in the cash account. What is the correct balance in the cash account?

Answers

Answer: $65,600

Explanation:

Debits should equal credits

Debits = Cash + Equipment + Land

= 49,900 + 16,000 + 47,500

= $113,400

Credits = Accounts Payable + Common stock + Notes Payable

= 31,600 + 35,000 + 62,500

= $129,100

The difference will be added to the Cash account where the error is from.

= 49,900 + (129,100 - 113,400)

= $65,600

Lawn Master Company, a manufacturer of riding lawn mowers, has a projected income for the coming year as follows: Sales $ 44,000,000 Operating expenses: Variable expenses $ 28,600,000 Fixed expenses 7,700,000 Total expenses 36,300,000 Operating profit $ 7,700,000 Required: 1. Determine the breakeven point in sales dollars. 2. Determine the required sales in dollars to earn a before-tax profit of $9,152,500. (Do not round intermediate calculations. Round your answer to the nearest whole dollar amount.) 3. What is the breakeven point in sales dollars if the variable expenses increases by 9%

Answers

Answer:

Please see attached

Explanation:

• Break even point in sales dollars $22,000,000

• Required sales in dollars $48,150,000

• Break even point in sales dollars $34,010,600

See as attached, detailed solution to the questions above.

Answer:

Results are below.

Explanation:

Giving the following information:

Sales $44,000,000

Variable expenses $ 28,600,000

Fixed expenses 7,700,000

To calculate the break-even point in dollars, we need to use the following formula:

Break-even point (dollars)= fixed costs/ contribution margin ratio

Break-even point (dollars)= 7,700,000 / [(44,000,000 - 28,600,000)/44,000,000]

Break-even point (dollars)= $22,000,000

Now, we incorporate the desired profit of $9,152,500

Break-even point (dollars)= (fixed costs + desired profit) / contribution margin ratio

Break-even point (dollars)= (7,700,000 + 9,152,500) /0.35

Break-even point (dollars)= $48,150,000

Finally, the new break-even point in dollars:

Total variable cost= 28,600,000*1.09= 31,174,000

Break-even point (dollars)= 7,700,000 / [(44,000,000 - 31,174,000) / 44,000,000]

Break-even point (dollars)= 7,700,000 / 0.2915

Break-even point (dollars)= $26,415,094.34

Goal-Setting, Expectancy, Reinforcement, and Equity Theory

Goal-Setting, Expectancy, Reinforcement, and Equity Theories all serve Theory Y managers in understanding how employees can be motivated at work. Employees seek interesting and challenging work in a fair work environment that allows for autonomy. There should be a system to engage everyone in the organization in goal setting and implementation as well as an expectation that effort expended will result in a positive outcome and be balanced from one employee to another (given the same work). Managers can also find success in fairness and a reward system that all employees value.

Goal-setting theory is based on the premise that employees are motivated when they are clear about the goals they are working toward. More importantly, they are more likely to engage to attain these goals if they collaborate with management in planning. Management by Objectives (MBO) is the process of discussion, review, and evaluation of goals between a manager and employee. Expectancy theory is based on the premise that the amount of effort employees exert on a specific task depends on their expectations of the outcome. Reinforcement theory states that individuals act to receive rewards and avoid punishment. A manager may attempt to surface good behaviors through rewards and extinguish poor behaviors through punishment. Equity theory zeros in on how employees' perceptions of fairness affect their willingness to perform.

Roll over each employee name to read a scenario. Match the scenario with the respective theory on the left by dragging the employee name to the corresponding theory.

1. Nathaniel has been late so much this month that he was not put on the project he requested to lead.

2. Robert does not want to go into work on his day off because he does not really need the overtime pay and that is the only benefit his boss offered.

3. Angela will be offered the role of team leader if she prepares a year-end profit and loss statement in Excel for the department, but she has not been trained to use Excel.

4. Rebecca's manager gave her a gift card to her favorite restaurant for having the highest value of sales in her department last month.

5. Gwen was glad she could sit down with her boss and plan the best schedule to accomplish her goals and objectives for the first quarter of the year.

6. Ruth found of that Liz is getting paid more per hour for doing the same job! Ruth has been with the company longer and her output is higher.

7. Jason is meeting with his manager to review the list of goals they spelled out last month to see what he has accomplished so far.

8. Daniel gave up his day off to help is boss hoping he would be appointed team leader, but the position was awarded to a co-worker who never helps out on the weekends!

A. Goal-setting

B. Expectancy

C. Reinforcement

D. Equity

Answers

Answer:

Goal-Setting, Expectancy, Reinforcement, and Equity Theories

Matching the scenario with respective theories:

A. Goal-setting : Gwen, Jason

B. Expectancy : Robert, Daniel

C. Reinforcement : Angela, Rebecca

D. Equity : Nathaniel, Ruth

Explanation:

Below are summaries of the different theories that can "serve Theory Y managers in understanding how employees can be motivated at work:"

A. Goal-setting Theory = setting clear goals

B. Expectancy Theory = acting based on the expected outcome

C. Reinforcement Theory = acting based on rewards and punishment

D. Equity Theory = willing to perform is based on perceived fairness

Match the scenario:

Part A. Goal-setting: Gwen, Jason

Part B. Expectancy: Robert, Daniel

Part C. Reinforcement: Angela, Rebecca

Part D. Equity: Nathaniel, Ruth

What is Equity?

In finance, equity is the right of assets that may have debts or other liabilities connected to them. Equity is estimated for accounting purposes by subtracting liabilities from the importance of the assets.

Descending are summaries of the different approaches that can "serve Theory Y managers in understanding how employees can be motivated at work:"

When the Goal-Setting, Expectancy, Reinforcement, and also Equity Theories

When the Matching the scenario with respective theories are:

Part A. Goal-setting Theory is = setting clear goals

Part B. Expectancy Theory is = acting based on the expected outcome

Part C. Reinforcement Theory is = acting based on rewards and punishment

Part D. Equity Theory is = willing to perform is based on perceived fairness

Find more information about Equity here:

https://brainly.com/question/25781151

Which scenario holds true when a tariff is applied to an imported item? A. both domestic and foreign consumers pay the same price B. domestic consumers of the imported item pay a higher price C. foreign consumers of the imported item pay a higher price D domestic consumers of the imported itern pay a lower price

Answers

Answer:

i would say b, the domestic pay more.

Last year Janet purchased a $1,000 face value corporate bond with an 11% annual coupon rate and a 15-year maturity. At the time of the purchase, it had an expected yield to maturity of 12.21%. If Janet sold the bond today for $993.14, what rate of return would she have earned for the past year? Do not round intermediate calculations. Round your answer to two decimal places.

Answers

Answer:

20.10%

Explanation:

The first task is to compute the bond's purchase price last year which is found using the bond price formula below:

bond price=face value/(1+r)^n+ annual coupon*(1-(1+r)^-n/r

face value=$1000

r=yield to maturity=12.21%

n=number of annual coupons in 15 years=15

annual coupon=face value*coupon rate=$1000*11%=$110

bond price=1000/(1+12.21%)^15+110*(1-(1+12.21%)^-15/12.21%

bond price=1000/(1+12.21%)^15+110*(1-0.177634192 )/12.21%

bond price=$918.50

Rate of return=(price today-initial price+coupon received)/initial price

price today= $993.14

initial price=$918.50

coupon received(for 1 year)=$110

Rate of return=($993.14-$918.50+$110)/$918.50=20.10%

Companies, the military, the government, and nonprofit organizations can operate because they have determined the levels of authority and reporting structure for their organizations. What is the name given to this line of authority

Answers

Answer:

Chain of command.

Explanation:

Chain of command is been used in the description of operation flow pattern in companies, government, universities and in many organisations which aid in a better reporting relationship. This report is said to set records straight and also puts every individual in a category in this chart organization. Also a chain of command is established so that everyone knows whom they should report to and what responsibilities are expected at their level. A chain of command enforces responsibility and accountability.

Jen Rogers withdrew a total of $15,000 from her business during the current year. The entry needed to close the withdrawals account is:_________

A. Debit Income Summary and credit Cash for $31,000.

B. Debit Jen Rogers, Withdrawals and credit Cash for $31,000 Debit Income Summary and credit Jen Rogers, Withdrawals for $31,000.

C. Debit Jen Rogers, Capital and credit Jen Rogers, Withdrawals for $31,000.

D. Debit Jen Rogers, Withdrawals and credit Jen Rogers, Capital for $31,000.

Answers

Answer: C. Debit Jen Rogers, Capital and credit Jen Rogers, Withdrawals for $15,000

Explanation:

The options do not match the question. Correct answer is posted.

When closing the Withdrawal account at the end of the period, the withdrawals need to be accounted for from the capital invested by the investor because the withdrawals would reduce the capital balance.

To do this the Capital account should be debited to signify that it is reducing. The opposing entry therefore will be to credit the Withdrawals account.

What type of buffer(s) (inventory, time, or capacity) would you expect to find in the following situations? a) A maker of custom cabinets b) A producer of automotive spare parts c) A hospital emergency room d) Wal-Mart e) Amazon f) A government contractor that builds submarines g) A bulk producer of various chemicals h) A maker of lawn mowers for K-mart and Target i) A freeway j) The space shuttle k) A business school

Answers

Answer:

a) A maker of custom cabinets ⇒ TIME, generally goods that are custom made take longer to produce and clients are aware of this.

b) A producer of automotive spare parts ⇒ CAPACITY, if more parts are needed, you will have to use spare capacity.

c) A hospital emergency room ⇒ CAPACITY, services cannot be stocked, therefore, the only possible buffer is capacity since they cannot make their patients wait in line (a dead person waiting in line is no longer a patient).

d) Wal-Mart ⇒ INVENTORY, whether a store is a brick and mortar or internet retailer, its cheapest safety stock (buffer) is generally inventory.

e) Amazon ⇒ INVENTORY, whether a store is a brick and mortar or internet retailer, its cheapest safety stock (buffer) is generally inventory.

f) A government contractor that builds submarines ⇒ TIME, submarines are very expensive and it takes years to build them, so a week more wouldn't make a difference.

h) A maker of lawn mowers for K-mart and Target ⇒ INVENTORY, the company probably knows when it is going to sell more, so it can add to its inventory of finished goods just in case.

i) A freeway ⇒ CAPACITY and then TIME, services cannot be stocked, and since it takes years to plan and build a highway or freeway, the only possible initial buffer is capacity. But once full capacity is reached, then the only buffer is time.

j) The space shuttle ⇒ INVENTORY, since you cannot go back to Earth just to get refueled, you must carry extra fuel just in case. The same for the rest of the stuff.

k) A business school ⇒ CAPACITY, services cannot be stocked, and no student will wait a few extra years just to get into the school that they love.

Suppose there are 100 million in the labor force, and 6 million unemployed people. During the next month, 200,000 people lose their jobs and 300,000 find jobs. The new total of employed persons is ________ and the new unemployment rate is ________.

Answers

Answer:

Results are below.

Explanation:

First, we need to calculate the currently employed people and the unemployment rate:

Employed people= 100,000,000 - 6,000,000= 94,000,000

Unemployment rate= unemployed people / labor force

Unemployment rate= 6,000,000 / 100,000,000

Unemployment rate= 0.06= 6%

Now, the newly employed people and the unemployment rate:

Employed people= 94,000,000 + 300,000 - 200,000

Employed people= 94,100,000

Unemployment rate= 5,900,000 / 100,000,000

Unemployment rate= 0.059 = 5.9%

Corentine Co. had $154,000 of accounts payable on September 30 and $133,500 on October 31. Total purchases on account during October were $283,000. Determine how much cash was paid on accounts payable during October. On September 30, Valerian Co. had a $103,500 balance in Accounts Receivable. During October, the company collected $103,890 from its credit customers. The October 31 balance in Accounts Receivable was $91,000. Determine the amount of sales on account that occurred in October. During October, Alameda Company had $104,500 of cash receipts and $105,150 of cash disbursements. The October 31 Cash balance was $19,600. Determine how much cash the company had at the close of business on September 30.

Answers

Answer:

Explanation:

a. Accounts Payable

Payments on account $303,500 | Beginning balance $154,000

| Purchases on account $283,000

|

| Ending balance $133500

b. Accounts Receivable

Beginning balance $103,500 | Cash receipts on account $103,890

Sales on account $91,390 |

|

Ending balance $91,000 |

c. Cash

Cash receipts $104,500 | Cash disbursements $105,150

Beginning balance $20,250 |

|

Ending balance $19,600 |

Assume Brad has a choice between two deposit accounts. Account WH has an annual percentage rate of 7.35% with interest compounded continuously. Account MW has an annual percentage rate of 7.45% with interest compounded monthly. Which account provides the highest effective annual return?

Answers

Answer: Account MW which compounds monthly provides a higher effective rate at 7.71%

Explanation:

Use the Effective Interest rate formula to see which offers the higher return.

Account WH;

Compounded continuously;

= e^(interest rate) - 1

= e^7.35% - 1

= 7.63%

Account MW

Compounded per month

= (( 1 + interest / compounding period) ^ period) - 1

= (( 1 + 7.45%/12) ^ 12) -1

= 7.71%

Suppose that, in a competitive market without government regulations, the equilibrium price of gasoline is $3.00 per gallon.

Complete the following table by indicating whether each of the statements is an example of a price ceiling or a price floor and whether it is binding or nonbinding.

Statement Price Control Binding or Not

The government prohibits gas stations from selling gasoline for more than $2.50 per gallon.

The government has instituted a legal minimum price of $3.40 per gallon for gasoline.

There are many teenagers who would like to work at gas stations, but they are not hired due to minimum-wage laws.

Answers

Answer:

Price ceiling binding

price floor binding

Price floor binding

Explanation:

A price floor is when the government or an agency of the government sets the minimum price of a product. A price floor is binding if it is set above equilibrium price.

Price ceiling is when the government or an agency of the government sets the maximum price for a product. It is binding when it is set below equilibrium price.

The maximum price ($2.50) is less than the equilibrium price($3) . So it is a binding price ceiling

The minimum price ($3.40) is greater than the equilibrium price($3) . So it is a binding price floor

None of the following would be an advantage of self-administered surveys:

A) Reduced cost

B) Respondent control

C) Reduced interview evaluation apprehension

A. True

B. False

Answers

Answer:

B. False

Explanation:

A self-administered survey is one where there is the collection of the necessary data for the survey is carried out through a questionnaire of questions to be answered by the interviewee. Questionnaires can be sent via mail, e-mail, personal interception, hand delivery etc.

The advantages of self-administered surveys are cost reduction, since questionnaires can be sent via email at no cost to both, greater control of the interviewee, since the questions can be developed according to the information you want to collect, greater quick feedback, which reduces the apprehension of the interview evaluation.

False, the self-administered surveys would not be advantageous in terms of reduced interview evaluation apprehension. The Option B.

Would self-administered surveys be advantageous?Self-administered surveys eliminate the need for face-to-face interactions and direct interviewer involvement which can indeed reduce interview evaluation apprehension. When individuals complete surveys on their own, they may feel less pressured and more comfortable expressing their opinions.

But this advantage does not hold true for self-administered surveys as they are completed by the respondents themselves without the presence of an interviewer. Consequently, the absence of an interviewer does not contribute to a reduction in interview evaluation apprehension. Therefore, the Option B is correct.

Read more about surveys

brainly.com/question/14610641

#SPJ6

Roose, Inc. reported revenue of $92 million and incurred total expenses of $84 million. The total expenses included cost of goods sold of $50 million, salaries and other administrative expenses of $9 million, $11 million of interest paid on a building's mortgage, and $14 million of depreciation. Assuming Roose is subject to the interest expense limitation, what amount of interest expense can the business deduct in the current year

Answers

Answer:

Roose, Inc.

The business can deduct $9.5 million in the current year.

Explanation:

Revenue = $92 million

Expenses allowed = 73 million ( $84 - $11 million for interest expense)

Adjusted taxable income before interest = $19 million

50% of adjusted taxable income = $9.5 million

Disallowed interest expense in the current year = $1.5 million

The interest expense allowed (deductible) is 50% for 2019 and 2020, as amended by the CARES Act) of the taxpayer's adjusted taxable income.

Total Company North South Sales $ 600,000 $ 400,000 $ 200,000 Variable expenses 360,000 280,000 80,000 Contribution margin 240,000 120,000 120,000 Traceable fixed expenses 120,000 60,000 60,000 Segment margin 120,000 $ 60,000 $ 60,000 Common fixed expenses 50,000 Net operating income $ 70,000 Required: 1. Compute the companywide break-even point in dollar sales. 2. Compute the break-even point in dollar sales for the North region. 3. Compute the break-even point in dollar sales for the South region.

Answers

Answer:

1. Company wide break-even point in dollar sales= $425,000

2. Break-even point in dollar sales for North region= $200,000

3. Break-even point in dollar sales for South region = $100,000

Explanation:

1. Computation of the companywide break-even point in dollar sales

First step is to find the Contribution margin ratio

Using this formula

Contribution margin ratio = Contribution margin / Sales

Contribution margin ratio:

Total company: ($240,000/$600,000)=0.4

North : ($120,000/$400,000)=0.4

South : ($120,000/$200,000)=0.6

Now let compute the Company wide break-even point in dollar sales using this formula

Company wide break-even point in dollar sales= Fixed costs / Contribution margin ratio

Let plug in the formula

Company wide break-even point in dollar sales= ($120,000 + $50,000) / 0.4

Company wide break-even point in dollar sales= $425,000

2. Computation for the break-even point in dollar sales for the North region using this formula

Break-even point in dollar sales for North region = Traceable fixed expenses / Contribution margin ratio

Let plug in the formula

Break-even point in dollar sales for North region= $60,000 / 0.3

Break-even point in dollar sales for North region= $200,000

3. . Computation for the break-even point in dollar sales for the South region.

Using this formula

Break-even point in dollar sales for South region = Traceable fixed expenses / Contribution margin ratio

Let plug in the formula

Break-even point in dollar sales for South region = $60,000 / 0.6

Break-even point in dollar sales for South region = $100,000

he Production Department of Hruska Corporation has submitted the following forecast of units to be produced by quarter for the upcoming fiscal year: 1st Quarter 2nd Quarter 3rd Quarter 4th Quarter Units to be produced 11,900 10,900 12,900 13,900 Each unit requires 0.20 direct labor-hours and direct laborers are paid $15.00 per hour. In addition, the variable manufacturing overhead rate is $1.50 per direct labor-hour. The fixed manufacturing overhead is $99,000 per quarter. The only noncash element of manufacturing overhead is depreciation, which is $39,000 per quarter. Required: 1. Calculate the company’s total estimated direct labor cost for each quarter of the the upcoming fiscal year and for the year as a whole. 2&3. Calculate the company’s total estimated manufacturing overhead cost and the cash disbursements for manufacturing overhead for each quarter of the upcoming fiscal year and for the year as a whole.

Answers

Answer:

1. Total estimated direct labor cost = $148,800

2. Total estimated manufacturing overhead cost = $410,880

3. Total Cash disbursement for the fiscal year = $254,880

Explanation:

Please see attached detailed explanation of the above questions and answers.

The following transactions occurred at the Daisy King Ice Cream Company.

1. Started business by issuing 10,000 shares of capital stock for $23,000.

2. Signed a franchise agreement to pay royalties of 5% of sales.

3. Leased a building for three years at $530 per month and paid six months' rent in advance.

4. Purchased equipment for $5,700, paying $2,000 down and signing a two-year, 10% note for the balance.

5. Purchased $2,100 of supplies on account.

6. Recorded cash sales of $1,100 for the first week.

7. Paid weekly salaries and wages, $470.

8. Paid for supplies purchased in item (5).

9. Paid royalties due on first week's sales.

10. Recorded depreciation on equipment, $70.

Required:

Prepare journal entries to record each of the transactions listed above. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.)

Journal Entries Needed as followed:

1. Started business by issuing 10,000 shares if capitol stock for $23,000

2. Signed a franchise agreement to pay royalties of 5% of sales

3. Leased a building for 3yrs st $530 per month and paid 6 months rent in advance

4. Purchased equipment for $5700, paying $2000 down and signing a 2yr 10% note for the balance.

5. Purchased $2100 of supplies on account

6. Recorded cash sales of $1100 for the 1st week

7. Paid weekly salareies and wages $4700

8. Paid for suplies purchased in item (5)

9. Paid royalites due on 1st weeks sales

10. Recorded depreciation on equipment $70

Answers

Answer:

Daisy King Ice Cream Company

General Journal

1. Debit Cash Account $23,000

Credit Capital Stock $23,000

To record the issue of 10,000 shares for cash.

2. No journal entry required.

3. Debit Prepaid Rent $3,180

Credit Cash Account $3,180

To record the payment in advance of six months' rent.

4. Debit Equipment $5,700

Credit Cash $2,000

Credit Notes Payable $3,700

To record the purchase of equipment for cash and 10% two-year notes.

5. Debit Supplies $2,100

Credit Accounts Payable $2,1000

To record the purchase of supplies on account.

6. Debit Cash Account $1,100

Credit Sales Revenue $1,100

To record the sale of goods for cash.

Debit Royalties Expense $55

Credit Royalties Payable $55

To record 5% royalties payable on sales.

7. Debit Salaries and Wages Expense $470

Credit Cash Account $470

To record the payment of weekly salaries and wages.

8. Debit Accounts Payable $2,100

Credit Cash Account $2,100

To record the payment for supplies purchase on account.

9. Debit Royalties Payable $55

Credit Cash Account $55

To record the payment of royalties due.

10. Debit Depreciation Expense $70

Credit Accumulated Depreciation $70

To record the depreciation expense for the period.

Explanation:

For Daisy King Ice Cream Company, the recording of business transactions in the journal is the first step of maintaining the double-entry system of book-keeping. In it, the accounts to be debited and credited are identified and recorded for onward posting to the general ledger.

Sachs Brands's defined benefit pension plan specifies annual retirement benefits equal to 1.6% × service years × final year's salary, payable at the end of each year. Angela Davenport was hired by Sachs at the beginning of 2007 and is expected to retire at the end of 2041 after 35 years' service. Her retirement is expected to span 18 years. Davenport's salary is $90,000 at the end of 2021 and the company's actuary projects her salary to be $240,000 at retirement. The actuary's discount rate is 7%. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Required: 2. Estimate by the projected benefits approach the amount of Davenport's annual retirement payments earned as of the end of 2021. 3. What is the company's projected benefit obligation at the end of 2021 with respect to Davenport? (Do not round intermediate calculations. Round your final answer to the nearest whole dollar.) 4. If no estimates are changed in the meantime, what will be the company's projected benefit obligation at the end of 2024 (three years later) with respect to Davenport? (Do not round intermediate calculations. Round your final answer to the nearest whole dollar.)

Answers

Answer:

Kindly check explanation

Explanation:

Given the following :

Annual retirement benefit plan: (1.6% * service years * final years' salary

Year of hire = beginning of 2007

Retiremet year = 2041

Years of service = 35

Required: 2. Estimate by the projected benefits approach the amount of Davenport's annual retirement payments earned as of the end of 2021.

1.6% * service years * final years' salary

Service years = 2021 - beginning of 2007 = 15 years on service

Salary at the end of 2021 = $90000

Hence,

1.6% * 15 * 90000 = $21,600

3. What is the company's projected benefit obligation at the end of 2021 with respect to Davenport?

Period (n) = Retiremet span = 18 years ; rate (r) = 7% ;

Present value of ordinary annuity $1 ; n = 18 ; r = 7% = 10.0591

$21,600 * 10.0591 = $217,276.56

= $217,277

Present value of retirement benefit at the end of 2041

PV factor $1 ; period (2041 - 2021) = 20 ; r = 7% = 0.258

$217,277 * 0.258 = $56,057.466

$56,057

4. If no estimates are changed in the meantime, what will be the company's projected benefit obligation at the end of 2024 (three years later) with respect to Davenport?

1.6% × 18 years × $90000 = $25920

Present value of ordinary annuity $1 ; n = 18 ; r = 7% = 10.0591

$25920 × 10.0591 = $260732

PV factor $1 ; period (2041 - 2021) = 20 - 3 = 17; n = 17 ; r = 7% = 0. 317

$260732 × 0.317 = $82652.044 = $82652

Joe is a regular customer. He's been in 4 times over the past two weeks. Each

time, he's received a wire transfer of $2000. He immediately sends a wire for

$500 and comes back into the store the next day to send 3 more money

transfers of $500 each to 3 different people.

The situation raises the following Red Flags (Select all that apply)

Joe has multiple friends.

Joe's transaction activity is frequent and for larger dollar amounts.

Joe is breaking up the transaction into smaller amounts.

Joe sometimes purchases other items in the store such as toothpaste and medicine.

Joe is breaking up received money into smaller amounts of money and sending to

several people.

Answers

Answer:

Joe's situation raises the following Red Flags:

Joe is breaking up the transaction into smaller amounts.

Explanation:

Joe is following money laundry footsteps. I suspect that he may be involved in some fraudulent practices, no wonder he is making some frantic efforts to launder the wire transfer of $2,000. He had completed sending some of the proceeds to some other persons. Perhaps, he will remit more cash in similar ways.

Answer:

Joe is breaking up the transaction into smaller accounts

Joe's transaction activity is frequent and for larger dollar amounts.

Joe is breaking up received money into smaller amounts of money and sending to several people

Explanation:

Hill Industries had sales in 2016 of $6,800,000 and a gross profit of $1,100,000. Management is considering two alternative budget plans to increase its gross profit in 2017.

Plan A would increase the selling price per unit from $8.00 to $8.40. Sales volume would decrease by 10% from its 2016 level. Plan B would decrease the selling price per unit by $0.50. The marketing department expects that the sales volume would increase by 100,000 units.

At the end of 2016, Hill has 40,000 units of inventory on hand. If Plan A is accepted, the 2017 ending inventory should be equal to 5% of the 2017 sales. If Plan B is accepted, the ending inventory should be equal to 60,000 units. Each unit produced will cost $1.80 indirect labor, $1.40 indirect materials, and $1.20 in variable overhead. The fixed overhead for 2017 should be $1,000,000.

1. Prepare a sales budget for 2017 under each plan. (Round Unit selling price answers to 2 decimal places, e.g. 52.70.)

2. Prepare a production budget for 2017 under each plan.

3. Compute the production cost per unit under each plan. (Round answers to 2 decimal places, e.g. 1.25.)

4. Compute the gross profit under each plan.

5. Which plan should be accepted?

Answers

Answer:

Results are below.

Explanation:

Giving the following information:

Plan A:

Selling price= $8.4

Sales in units= (6,800,000/8)*0.9= 765,000

Ending inventory should be equal to 5% of the 2017 sales.

Plan B:

Selling price= $7.5

Sales in units= 850,000 + 100,000= 950,000

Ending inventory should be equal to 60,000 units.

Beginning inventory= 40,000 units

Total unitary variable cost= 1.8 + 1.4 + 1.2= $4.4

Total fixed overhead= $1,000,000

a)

Plan A:

Sales in units= (6,800,000/8)*0.9= 765,000

Sales in dollars= 765,000*8.4= $6,426,000

Plan B:

Sales in units= 850,000 + 100,000= 950,000

Sales in dollars= 950,000*7.5= $7,125,000

b) Production= sales + desired ending inventory - beginning inventory

Plan A:

Production= 765,000 + (765,000*0.05) - 40,000

Production= 763,250

Plan B:

Production= 950,000 + 60,000 - 40,000

Production= 970,000

c)

Plan A:

Unitary variable cost= 4.4

Unitary fixed cost= 1,000,000/763,250= 1.31

Total unitary cost= $5.71

Plan B:

Unitary variable cost= 4.4

Unitary fixed cost= 1,000,000/970,000= 1.031

Total unitary cost= $5.43

d) Gross profit= sales - cost of goods sold

Plan A:

Gross profit= 6,426,000 - 765,000*5.71= $2,057,850

Plan B:

Gross profit= 7,125,000 - 950,000*5.43= $1,966,500

e) The best plan is the one with the highest profit. In this case, Plan A is better.

Ramon had AGI of $165,000 in 2020. He is considering making a charitable contribution this year to the American Heart Association, a qualified charitable organization. Determine the current allowable charitable contribution deduction in each of the following independent situations, and indicate the treatment for any amount that is not deductible currently. Identify any planning ideas to minimize Ramon's tax liability.

Answers

Answer:

the situations are missing, so I looked for similar questions:

a. A cash gift of $68,500.

In the current year, Ramon may deduct $68,500 since his charitable contribution is limited to $165,000.

b. A gift of OakCo stock worth $68,500 on the contribution date. Ramon had acquired the stock as an investment two years ago at a cost of $61,650.

The stock's value for determining the contribution is $68,500 (fair market value). The deduction for 2020 is $49,500 (30% of AGI). The remaining $19,000 for years.

c. A gift of a painting worth $68,500 that Ramon purchased three years ago for $61,650. The charity has indicated that it would sell the painting to generate cash to fund medical research.

The contribution is valued at $61,650 (the charity will sell the painting immediately). The amount deductible in the current year is $61,650.

Explanation:

The charitable contribution limit was increased to 100% of AGI for 2020 by the CARES Act (Coronavirus Aid, Relief, and Economic Security Act).

To what three different audiences might you have to give a presentation? How would the presentation differ for each? Which one would be the most challeng- ing for you?

Answers

Answer:

Please see explanation below.

Explanation:

°To what three different audiences might you have to give a presentation.

Answer:

• Senior manager

• Project manager

• Team leader.

° How would the presentation differ for each.

• Senior manager. The senior manager will be presented with existing IT structures in a brief manner. In addition to being given the short description of the previous IT system, a short explanation of the newly built and improvement on these existing systems will as well be presented to the senior manager.

• Project manager. A project manager would be presented with detailed description of the project. This is because the project manager must have first knowledge of the whole project and will be held accountable for the success or failure of the project. He would also be giving reports to the senior managers.

• Team leader. The details of the current process as the project progresses will be shared with the team leader.

° Which one will be the most challenging for you.

The most challenging for me will be the project manager because he would have to be presented with a well detailed and thorough description of the whole project. More so, further details of the cost expended on the system will be shared with the project manager.

A perpetuity pays $170 per year and interest rates are 8.2 percent. How much would its value change if interest rates increased to 9.7 percent

Answers

Answer:

$320.59 decrease

Explanation:

The computation of the change in the value is shown below:

As we know that

The Value of perpetuity is

= Annual inflows ÷ interest rate

Current value is

= $170 ÷ 0.082

= $2,073.17

And,

New value is

= $170 ÷ 0.097

= $1,752.58

Now change in value is

= $2,073.17 - $1,752.58

= $320.59 decrease

We simply applied the above formula

The economic concept of scarcity refers to the idea that : APEX

Answers

Answer: Resources required to fulfil our needs are insufficient

Explanation:

Scarcity in economics is the term used to describe the notion that the needs of a society are infinite but the resources needed to satisfy these needs are finite.

This is why humans have to constantly make a trade-off between resources needed to satisfy a need by picking one alternative course of action that requires a resource over another.

Answer:

People have limited resources to fulfill their unlimited wants.

Explanation:

g Question 3 (ASC Required - 20 points): After graduation, you work for a few years at a major accounting firm and advance to Senior. However, as part of this role, you start working on a client that is different from your other background: specifically, a major bank located in San Francisco. This bank primarily takes deposits from retail and business customers and lends money out to others. The accounting seems to be completely different from what you are used to and so you go to the Codification to find out what the accounting standards for this industry consist of. Describe the major classes of transactions undertaken by this sort of entity and how they should be accounted for.

Answers

Answer with Explanation:

The major transactions that a bank will be involved in are listed below:

Deposits of accounts holders: These deposits are basically the liability of the bank which it will pay them back in near future. Hence it must be recorded as a Current or Non-current liability depending upon the type of account and agreement between the parties to contract. Money lendings to borrowers: This money must be accounted for as a current or non-current asset depending upon the type of account and agreement made.Interest on the money lendings: It is interest income and must be accounted for as revenue.ATM and other Transaction processing charges: These fee charges are also part of income and thus must be accounted for as income.Lilliput is a country that has closed borders and does not import or export any goods or services; hence, they do not worry about trade with other countries. Total spending for the federal government of Lilliput for the last fiscal year was $4.71 billion. The country collected $4.83 billion in taxes during this same fiscal year. Assume government transfers were zero. Based on this information, what is Lilliput's budget balance

Answers

Answer: $0.12 billion

Explanation:

Based on the information given in the question:

Total spending for Lilliput last fiscal year = $4.71 billion

Tax collected(Revenue)= $4.83 billion

Government transfers = $0

Lilliput's budget balance based on the information provided will be:

= (Taxes - Government transfers) - Government expenditures

= ($4.83 billion - $0) - $4.71 billion

= $0.12 billion